According the Census bureau report seasonally adjusted new home sales were down 2.2% year over year. Delving into the data a little further shows a much uglier picture for the coastal market (where prices are the most inflated).

In the Northeast, home sales have fallen 29.1% from September 2004 to September 2005.

In the West, home sale ahve fallen 16.2% from September 2004 to September 2005.

The only area holding up the report is the South (the cheapest area in the US) where home sales have surged 14.1% from September 2004 to September 2005.

If the coastal markets were the forerunners to the rest of the nation's housing boom, then they may also be the leading indicator of the broader nation's housing downturn.

Friday, October 28, 2005

Luxury Home Sales Stalling

From Florida:

Dennis Sheppard, owner of Dennis Sheppard Realty in Indian Harbour Beach, called the latest decrease in median price "odd," but he said it could indicate something he had been noticing: Higher-priced homes -- those $500,000 and above -- seem to be taking longer to sell

Florida Luxury Homes Stalling

Anecdotally, I was a real estate industry meeting this morning with several people from Lennar. They are currently seeing the same trend in California that the preceding article notes in Florida. High end homes ($1+ million in California) are selling slower, while the cheap homes (under $600k in California) are still selling well.

Dennis Sheppard, owner of Dennis Sheppard Realty in Indian Harbour Beach, called the latest decrease in median price "odd," but he said it could indicate something he had been noticing: Higher-priced homes -- those $500,000 and above -- seem to be taking longer to sell

Florida Luxury Homes Stalling

Anecdotally, I was a real estate industry meeting this morning with several people from Lennar. They are currently seeing the same trend in California that the preceding article notes in Florida. High end homes ($1+ million in California) are selling slower, while the cheap homes (under $600k in California) are still selling well.

Thursday, October 13, 2005

Tough Christmas?

Could be a tough Christmas for consumers this year with:

1. Heating oil skyrocketing and a cold winter expected in the Northeast

2. Mortgage rates on the rise

3. Credit Card Minimum Payments Increasing in January

4. Personal savings rates are negative

I predict one final dip into the home equity ATM may just save Christmas this year, but it could be a stretched holiday for a lot of consumers.

1. Heating oil skyrocketing and a cold winter expected in the Northeast

2. Mortgage rates on the rise

3. Credit Card Minimum Payments Increasing in January

4. Personal savings rates are negative

I predict one final dip into the home equity ATM may just save Christmas this year, but it could be a stretched holiday for a lot of consumers.

Sunday, October 02, 2005

Lenders Tightening Loan Standards

Several lenders are tightening loan standards in the next month. Look's like Greenspan's jaw-boning this summer did have some impact. Or maybe the lenders just got tired of their disappearing profit margins.

Washington Mutual:

Told mortgage brokers that it will make it more difficult for borrowers to qualify for its option ARMs, which carry an introductory rate of as low as 1.25%. Under the new rules, which are expected to take effect next month, borrowers will have to show they can afford the monthly payment if the interest rate on the loan is 6% -- or 6.25% for borrowers purchasing a second-home or investment property -- after the introductory rate expires. Currently, the bank's rate for qualifying borrowers for these loans is roughly 5.25%

In mid-August, Washington Mutual increased the margin on its option ARMs by 0.20 percentage point to 2.5%. As a result, a borrower who took out an option ARM tied to one popular index -- the 12-month Moving Treasury Average -- might pay 5.52% instead of 5.32%.

New Century:

Said it was aiming to reduce the amount of interest-only loans it grants to less than 25% of total loan production from 33% in the year's first half. New Century said it was making the move in an effort to boost profit margins.

Option One:

This month, Option One Mortgage, a unit of H&R Block Inc., boosted the rates on all of its mortgage products by 0.40 percentage point. Option One says the move reflects both rising interest rates and changes in investor appetite for its loans.

Golden West Financial:

says that next month it will raise the introductory rate for its option ARMs to 2.20% from 1.95%. The rise "will be the first of several moves," says Golden West Chairman and CEO Herbert Sandler. "I don't know how high it will go, but it should go higher," he adds.

Washington Mutual:

Told mortgage brokers that it will make it more difficult for borrowers to qualify for its option ARMs, which carry an introductory rate of as low as 1.25%. Under the new rules, which are expected to take effect next month, borrowers will have to show they can afford the monthly payment if the interest rate on the loan is 6% -- or 6.25% for borrowers purchasing a second-home or investment property -- after the introductory rate expires. Currently, the bank's rate for qualifying borrowers for these loans is roughly 5.25%

In mid-August, Washington Mutual increased the margin on its option ARMs by 0.20 percentage point to 2.5%. As a result, a borrower who took out an option ARM tied to one popular index -- the 12-month Moving Treasury Average -- might pay 5.52% instead of 5.32%.

New Century:

Said it was aiming to reduce the amount of interest-only loans it grants to less than 25% of total loan production from 33% in the year's first half. New Century said it was making the move in an effort to boost profit margins.

Option One:

This month, Option One Mortgage, a unit of H&R Block Inc., boosted the rates on all of its mortgage products by 0.40 percentage point. Option One says the move reflects both rising interest rates and changes in investor appetite for its loans.

Golden West Financial:

says that next month it will raise the introductory rate for its option ARMs to 2.20% from 1.95%. The rise "will be the first of several moves," says Golden West Chairman and CEO Herbert Sandler. "I don't know how high it will go, but it should go higher," he adds.

Monday, September 26, 2005

Credit Card Minimum Increasing in Oct.

From SanDiegoReader.com

Next month, people who have held a credit card for some time should get a surprise: each month, they will have to pay 4 percent of the outstanding balance on the card, not 2 percent. This move was dictated by the federal government's comptroller of the currency in 2003. The phase-in for new customers began in the summer, and October is the big month for existing customers. It's not small change. Almost 40 percent of credit-card holders pay only the minimum balance, according to Cardweb.com.

The average household credit-card balance is around $9000, according to Boston's Babson Capital. Previously, families paid a minimum of $180 a month. Now, they will have to pay $360 each month.

With gas at $3.00 per gallon and the credit card minimum increasing in October, Christmas could be a very interesting time for the consumer this year. Look for increased refinancings and home equity extraction next month as consumers tap their home ATMs to compensate.

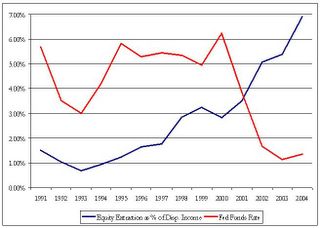

Greenspan's Bubble Research

Greenspan appears to be so concerned about the potential economic impact of the housing bubble that he published a research report titled Estimates of Home Mortgage Originations, Repayments, and Debt On One-to-Four-Family Residences about the most nefarious result of the bubble, equity extraction. This is significant because the paper (a collaboration with James Kennedy) marks only the 2nd time in his career as Fed Chairmen Greenspan has published any of his research (the 1st was in 1997 and was on the Auto Industry). Most economists have felt that equity extraction has been driving consumer spending in America, which is driving about 70% of GDP. Now Greenspan has provided the research that proves it. Of course, the Fed has no one to blame but themselves for this Equity Extraction bubble, as the graph shows (and we all know intuitively) that Equity Extraction is inversely correlated with the Fed Funds rate. It is scary to think what may happen to the economy if the Equity Extraction does slow.

Subscribe to:

Comments (Atom)