According the Census bureau report seasonally adjusted new home sales were down 2.2% year over year. Delving into the data a little further shows a much uglier picture for the coastal market (where prices are the most inflated).

In the Northeast, home sales have fallen 29.1% from September 2004 to September 2005.

In the West, home sale ahve fallen 16.2% from September 2004 to September 2005.

The only area holding up the report is the South (the cheapest area in the US) where home sales have surged 14.1% from September 2004 to September 2005.

If the coastal markets were the forerunners to the rest of the nation's housing boom, then they may also be the leading indicator of the broader nation's housing downturn.

Friday, October 28, 2005

Luxury Home Sales Stalling

From Florida:

Dennis Sheppard, owner of Dennis Sheppard Realty in Indian Harbour Beach, called the latest decrease in median price "odd," but he said it could indicate something he had been noticing: Higher-priced homes -- those $500,000 and above -- seem to be taking longer to sell

Florida Luxury Homes Stalling

Anecdotally, I was a real estate industry meeting this morning with several people from Lennar. They are currently seeing the same trend in California that the preceding article notes in Florida. High end homes ($1+ million in California) are selling slower, while the cheap homes (under $600k in California) are still selling well.

Dennis Sheppard, owner of Dennis Sheppard Realty in Indian Harbour Beach, called the latest decrease in median price "odd," but he said it could indicate something he had been noticing: Higher-priced homes -- those $500,000 and above -- seem to be taking longer to sell

Florida Luxury Homes Stalling

Anecdotally, I was a real estate industry meeting this morning with several people from Lennar. They are currently seeing the same trend in California that the preceding article notes in Florida. High end homes ($1+ million in California) are selling slower, while the cheap homes (under $600k in California) are still selling well.

Thursday, October 13, 2005

Tough Christmas?

Could be a tough Christmas for consumers this year with:

1. Heating oil skyrocketing and a cold winter expected in the Northeast

2. Mortgage rates on the rise

3. Credit Card Minimum Payments Increasing in January

4. Personal savings rates are negative

I predict one final dip into the home equity ATM may just save Christmas this year, but it could be a stretched holiday for a lot of consumers.

1. Heating oil skyrocketing and a cold winter expected in the Northeast

2. Mortgage rates on the rise

3. Credit Card Minimum Payments Increasing in January

4. Personal savings rates are negative

I predict one final dip into the home equity ATM may just save Christmas this year, but it could be a stretched holiday for a lot of consumers.

Sunday, October 02, 2005

Lenders Tightening Loan Standards

Several lenders are tightening loan standards in the next month. Look's like Greenspan's jaw-boning this summer did have some impact. Or maybe the lenders just got tired of their disappearing profit margins.

Washington Mutual:

Told mortgage brokers that it will make it more difficult for borrowers to qualify for its option ARMs, which carry an introductory rate of as low as 1.25%. Under the new rules, which are expected to take effect next month, borrowers will have to show they can afford the monthly payment if the interest rate on the loan is 6% -- or 6.25% for borrowers purchasing a second-home or investment property -- after the introductory rate expires. Currently, the bank's rate for qualifying borrowers for these loans is roughly 5.25%

In mid-August, Washington Mutual increased the margin on its option ARMs by 0.20 percentage point to 2.5%. As a result, a borrower who took out an option ARM tied to one popular index -- the 12-month Moving Treasury Average -- might pay 5.52% instead of 5.32%.

New Century:

Said it was aiming to reduce the amount of interest-only loans it grants to less than 25% of total loan production from 33% in the year's first half. New Century said it was making the move in an effort to boost profit margins.

Option One:

This month, Option One Mortgage, a unit of H&R Block Inc., boosted the rates on all of its mortgage products by 0.40 percentage point. Option One says the move reflects both rising interest rates and changes in investor appetite for its loans.

Golden West Financial:

says that next month it will raise the introductory rate for its option ARMs to 2.20% from 1.95%. The rise "will be the first of several moves," says Golden West Chairman and CEO Herbert Sandler. "I don't know how high it will go, but it should go higher," he adds.

Washington Mutual:

Told mortgage brokers that it will make it more difficult for borrowers to qualify for its option ARMs, which carry an introductory rate of as low as 1.25%. Under the new rules, which are expected to take effect next month, borrowers will have to show they can afford the monthly payment if the interest rate on the loan is 6% -- or 6.25% for borrowers purchasing a second-home or investment property -- after the introductory rate expires. Currently, the bank's rate for qualifying borrowers for these loans is roughly 5.25%

In mid-August, Washington Mutual increased the margin on its option ARMs by 0.20 percentage point to 2.5%. As a result, a borrower who took out an option ARM tied to one popular index -- the 12-month Moving Treasury Average -- might pay 5.52% instead of 5.32%.

New Century:

Said it was aiming to reduce the amount of interest-only loans it grants to less than 25% of total loan production from 33% in the year's first half. New Century said it was making the move in an effort to boost profit margins.

Option One:

This month, Option One Mortgage, a unit of H&R Block Inc., boosted the rates on all of its mortgage products by 0.40 percentage point. Option One says the move reflects both rising interest rates and changes in investor appetite for its loans.

Golden West Financial:

says that next month it will raise the introductory rate for its option ARMs to 2.20% from 1.95%. The rise "will be the first of several moves," says Golden West Chairman and CEO Herbert Sandler. "I don't know how high it will go, but it should go higher," he adds.

Monday, September 26, 2005

Credit Card Minimum Increasing in Oct.

From SanDiegoReader.com

Next month, people who have held a credit card for some time should get a surprise: each month, they will have to pay 4 percent of the outstanding balance on the card, not 2 percent. This move was dictated by the federal government's comptroller of the currency in 2003. The phase-in for new customers began in the summer, and October is the big month for existing customers. It's not small change. Almost 40 percent of credit-card holders pay only the minimum balance, according to Cardweb.com.

The average household credit-card balance is around $9000, according to Boston's Babson Capital. Previously, families paid a minimum of $180 a month. Now, they will have to pay $360 each month.

With gas at $3.00 per gallon and the credit card minimum increasing in October, Christmas could be a very interesting time for the consumer this year. Look for increased refinancings and home equity extraction next month as consumers tap their home ATMs to compensate.

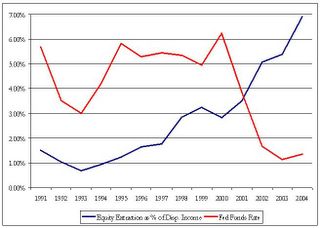

Greenspan's Bubble Research

Greenspan appears to be so concerned about the potential economic impact of the housing bubble that he published a research report titled Estimates of Home Mortgage Originations, Repayments, and Debt On One-to-Four-Family Residences about the most nefarious result of the bubble, equity extraction. This is significant because the paper (a collaboration with James Kennedy) marks only the 2nd time in his career as Fed Chairmen Greenspan has published any of his research (the 1st was in 1997 and was on the Auto Industry). Most economists have felt that equity extraction has been driving consumer spending in America, which is driving about 70% of GDP. Now Greenspan has provided the research that proves it. Of course, the Fed has no one to blame but themselves for this Equity Extraction bubble, as the graph shows (and we all know intuitively) that Equity Extraction is inversely correlated with the Fed Funds rate. It is scary to think what may happen to the economy if the Equity Extraction does slow.

Friday, June 17, 2005

Trillion Dollar Kablooie

Volume of ARMs Adjusting by Year:

2005: $80 billion

2006: $300 billion

2007: $1 trillion

The 2007 figure according to the NY Times represents 12% of outstanding mortgages.

12% of mortgages adjusting in one year is going to be painful. Even if long term rates remain low, ARMs are predominantly written off short term rates, which have risen dramatically in the past 2 years.

2005: $80 billion

2006: $300 billion

2007: $1 trillion

The 2007 figure according to the NY Times represents 12% of outstanding mortgages.

12% of mortgages adjusting in one year is going to be painful. Even if long term rates remain low, ARMs are predominantly written off short term rates, which have risen dramatically in the past 2 years.

Wednesday, June 15, 2005

Durable Good to Asset Class

I believe that the concept of home ownership has fundamentally changed in the United States in the past 3 years. Homes have been transformed from a durable good into an asset class. Historically, a home has been a long lasting durable good. It functioned as a place of shelter, security, and comfort. Homes were purchased for the tangible benefits they provided the owner. Today homes are an asset class. People buy homes because they believe they will receive a return from owning one. Even when someone buy a home for the tangible benefits it provides they still fundamentally believe they can and will make money from owning it. This shift helps to explain why 40% of the homes purchased in 2004 were for second-home or investment purposes. It also explains why transaction volume has doubled in the last few years. You live in a home, but you trade an asset.

Homes are a perverted asset class. Unlike stocks, bonds, or even commercial real estate an occupied home produces no income. And in the hottest markets the income from renting a home does not cover the mortgage payment. Homes are not easily traded and have high transactions costs for doing so. But if enough people see their homes as investments, than homes become an asset class.

If homes are an asset they can lose money, a lot of money and many people can get hurt. If homes are an asset people are going to sell them just like they sell stocks or bonds when they depreciate. This is in sharp contrast to the past when people thought of their homes principally as a place to live and thus a downturn gave them no reason to exit, because a fall in financial value changed nothing about the tangible benefits a home provides (shelter, security, etc.). However, a fall in value changes a lot about the benefits an asset provides (returns). It will be very easy for the investors who bought 40% of homes last year to walk if home values fall, because they don't live in their assets.

Homes are a perverted asset class. Unlike stocks, bonds, or even commercial real estate an occupied home produces no income. And in the hottest markets the income from renting a home does not cover the mortgage payment. Homes are not easily traded and have high transactions costs for doing so. But if enough people see their homes as investments, than homes become an asset class.

If homes are an asset they can lose money, a lot of money and many people can get hurt. If homes are an asset people are going to sell them just like they sell stocks or bonds when they depreciate. This is in sharp contrast to the past when people thought of their homes principally as a place to live and thus a downturn gave them no reason to exit, because a fall in financial value changed nothing about the tangible benefits a home provides (shelter, security, etc.). However, a fall in value changes a lot about the benefits an asset provides (returns). It will be very easy for the investors who bought 40% of homes last year to walk if home values fall, because they don't live in their assets.

KB Homes- NO BUBBLE

I saw Bruce Karatz, CEO of KB Homes, speak today at a real estate conference. He explicitly said that there was no bubble and that housing prices have appreciated because of fundamental demographic changes. He completely avoided talking about the impact of interest rates and went as far as saying that sales volume may remain at record levels for the next 20 years. While I think his opinions are preposterous, I understand that as the CEO of a publicly traded home builder there is no way he can say there is a bubble.

He made no mention of any fundamental economic drivers of home price appreciation other than job growth, which he claimed was less than stellar. Bruce also claimed that homes will not drop in value because there has been little over building compared to previous cycles. While most public homebuilders learned their lesson about spec building in the last cycle and have vastly reduced their WIP. The potential for oversupply still exists, if according to the NAR 40% of the new homes in 2004 were sold for investment or second home purchases, these can come back on the market quickly. People do not move out of the homes they occupy if they go down on value, but if their investment properties go down, why would they not get out?

He made no mention of any fundamental economic drivers of home price appreciation other than job growth, which he claimed was less than stellar. Bruce also claimed that homes will not drop in value because there has been little over building compared to previous cycles. While most public homebuilders learned their lesson about spec building in the last cycle and have vastly reduced their WIP. The potential for oversupply still exists, if according to the NAR 40% of the new homes in 2004 were sold for investment or second home purchases, these can come back on the market quickly. People do not move out of the homes they occupy if they go down on value, but if their investment properties go down, why would they not get out?

Monday, May 30, 2005

Mortgage Bankers Bailing Out

I realize this is extremely anecdotal evidence, but since real estate is driven by human emotions I believe it is applicable to my "bubble" thesis. In a prescient move, the Chief Economist of the Mortgage Bankers Association, Douglas Duncan, commented this week that he is selling his home in Washington DC, which has tripled in value in the last twelve years, and is going to rent. Duncan expects, "significant reversals" in regions that have enjoyed strong home price appreciation, including Washington, D.C., Florida and California. If home prices in DC tripling over the past dozen years is disconcerting, than California prices tripling in the last 6 years must by nauseating.

This story brings to mind an axiom that my portfolio management professor gave me: "In every transaction there are three people, a seller, a buyer, and a broker, but only one of them is guaranteed to make money." It is because brokers are guaranteed to make money that they are constant cheerleaders, pushing markets higher and lower, but always demanding more transactions. So it particularly auspicious that the chief economist for the Mortgage Brokers Association is raising the red flag on this out of control market. A person whose principal job is to encourage mortgage transactions sees the market as so wreckless that his ethics and humanity (but more likely desire for self preservation) are overwhelming his role as mortgage lending cheerleader. If the the chief economist for the National Association of Realtors, announces that he sold his house because the market is overheated, than head for the hills because a tidal wave will imminently strike the housing market.

This story brings to mind an axiom that my portfolio management professor gave me: "In every transaction there are three people, a seller, a buyer, and a broker, but only one of them is guaranteed to make money." It is because brokers are guaranteed to make money that they are constant cheerleaders, pushing markets higher and lower, but always demanding more transactions. So it particularly auspicious that the chief economist for the Mortgage Brokers Association is raising the red flag on this out of control market. A person whose principal job is to encourage mortgage transactions sees the market as so wreckless that his ethics and humanity (but more likely desire for self preservation) are overwhelming his role as mortgage lending cheerleader. If the the chief economist for the National Association of Realtors, announces that he sold his house because the market is overheated, than head for the hills because a tidal wave will imminently strike the housing market.

Thursday, May 26, 2005

Fed Pres. Calls Florida Bubble Market

Although the primary focus of my blog is the real estate market in California, I chose to discuss South Florida for today's entry. I think there are obvious corollaries between South Florida and California markets. Both market have seen little employment growth in the past 4 years, both have had minor wage growth, both are seeing large amounts of homes purchased for speculation, and both are driven by low money down-adjustable rate loans.

Today some insignificant person at the Federal Reserve, Jack Guynn, President of the Atlanta Federal Reserve bank explicitly called Florida a bubble market. I refer to him as insignificant because the market has ignored all warnings from the Federal Reserve about the impact of rising rates on home values. As well, lenders continue their aggressive underwriting despite the toothless letter from the Federal Reserve last week telling them to tighten credit standards.

But back to the main topic, Florida. President Guynn said at a home builders group meeting, "There are some local markets, especially in coastal Florida, where I've heard stories for more than a year about behavior that's got to be characterized as nothing other than speculation." I wonder if the homebuilders threw their chairs at him, after he dared to imply that the market is being driven by speculation? This seems like a part of the Fed's strategy to talk the housing market down just as Greenspan did by calling the stock market "irrationally exuberant". I wonder if there are Fed President flying all over the country meeting with homebuilders warning them about the dangers of housing? I'm sure that many homebuilders will slow down their cash flow juggernauts if the Fed asks them to do so nicely. This was very effective at taking the punch bowl away from the tech bubble back in 1998.

Guynn concluded his remarks by saying, "some buyers, some builders, some lenders are going to get burned, could very likely get burned." Greenspan is a recent speech stated that it was only the home owners who buy right before the market turns down that really need to worry. Sounds like there is some growing rancour inside the Fed's Crystal Palace in regards to how big and damaging the real estate bubble may be.

Today some insignificant person at the Federal Reserve, Jack Guynn, President of the Atlanta Federal Reserve bank explicitly called Florida a bubble market. I refer to him as insignificant because the market has ignored all warnings from the Federal Reserve about the impact of rising rates on home values. As well, lenders continue their aggressive underwriting despite the toothless letter from the Federal Reserve last week telling them to tighten credit standards.

But back to the main topic, Florida. President Guynn said at a home builders group meeting, "There are some local markets, especially in coastal Florida, where I've heard stories for more than a year about behavior that's got to be characterized as nothing other than speculation." I wonder if the homebuilders threw their chairs at him, after he dared to imply that the market is being driven by speculation? This seems like a part of the Fed's strategy to talk the housing market down just as Greenspan did by calling the stock market "irrationally exuberant". I wonder if there are Fed President flying all over the country meeting with homebuilders warning them about the dangers of housing? I'm sure that many homebuilders will slow down their cash flow juggernauts if the Fed asks them to do so nicely. This was very effective at taking the punch bowl away from the tech bubble back in 1998.

Guynn concluded his remarks by saying, "some buyers, some builders, some lenders are going to get burned, could very likely get burned." Greenspan is a recent speech stated that it was only the home owners who buy right before the market turns down that really need to worry. Sounds like there is some growing rancour inside the Fed's Crystal Palace in regards to how big and damaging the real estate bubble may be.

Friday, May 20, 2005

When the Shoeshine Boys Say Buy...

I blatantly ripped this quote out of the WSJ (5.19.2005), because it is so striking:

A surge in the number of people buying houses as a speculative investment is the contemporary equivalent of the story about Joseph P. Kennedy, father of the late president. According to the tale, he sold his stocks a week before the 1929 crash because he heard a shoeshine boy named Billy touting U.S. Steel and RCA. When the shoeshine boy starts giving you tips, he is supposed to have said, it's time to get out of the market.

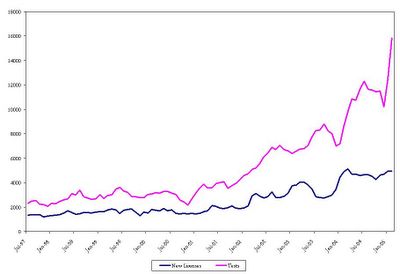

If you are to get out of the market, when the shoeshine boy starts giving you stock tips, then what are we to do when the shoeshine boy trades in his polish and becomes a stock broker? As you can see from the chart below, that is exactly what has occurred. Thousands of shoeshines boys hoodwinked by dreams of quick prosperity are turning into Realtors. These figures from the California DRE reveal that number of new real estate agent licensees in California has surged from 1,300 a month in 1997 to nearly 5,000 a month in April 2005. Of course, that is pittance compared to the surge in people taking the test, which has increased from 2,500 per month in 1997 to nearly 16,000 per month in 2005. The pink line is test takers and the blue line is new licensees.

Posted by Hello

No wonder it is getting so expensive to have my shoes shined.

A surge in the number of people buying houses as a speculative investment is the contemporary equivalent of the story about Joseph P. Kennedy, father of the late president. According to the tale, he sold his stocks a week before the 1929 crash because he heard a shoeshine boy named Billy touting U.S. Steel and RCA. When the shoeshine boy starts giving you tips, he is supposed to have said, it's time to get out of the market.

If you are to get out of the market, when the shoeshine boy starts giving you stock tips, then what are we to do when the shoeshine boy trades in his polish and becomes a stock broker? As you can see from the chart below, that is exactly what has occurred. Thousands of shoeshines boys hoodwinked by dreams of quick prosperity are turning into Realtors. These figures from the California DRE reveal that number of new real estate agent licensees in California has surged from 1,300 a month in 1997 to nearly 5,000 a month in April 2005. Of course, that is pittance compared to the surge in people taking the test, which has increased from 2,500 per month in 1997 to nearly 16,000 per month in 2005. The pink line is test takers and the blue line is new licensees.

Posted by Hello

No wonder it is getting so expensive to have my shoes shined.

Thursday, May 19, 2005

Retail Rocketship

Singling out any product type in commercial real estate as being over-inflated compared to other types at this point is like trying to describe the difference between a 9.0 and a 10.0 earthquake. They both are bad. That being said, I believe that retail property investing has become particularly risky and current cap rates of 6.0-6.5% in no way compensate for this risk. (Compare these cap rates to long term averages of 8.5-10%.)

Risks of Retail

1. The past 5 years have seen record growth in consumer spending, which is driving retail property rent growth. However, job growth and wage growth have been essentially flat. The primary source of consumer spending has been increased leveraging, particularly of consumer's homes. Even if home prices continue to rise there is a limit to the amount of leverage people can take on and as we approach that limit increases in consumption driven by borrowing will decelerate. If interest rate rise without corresponding wage increases consumption will be reduced the increase debt servicing costs. Americans are not saving (current savings is less than 2% of disposable income), therefore increased debt service will automatically lead to reduced consumption. Reduced consumption will hurt retail rent growth.

2. Retail tenants are operating businesses. Therefore every year some are likely to fail and not pay their rent. There is little room with a 6% yield to have too many vacancies.

Retail Returns

A retail property trading at 6% cap rate typically has rent growth of about CPI +.5%. Therefore real return is:

Real Return = 6% + CPI + .5% -CPI = 6.5%

Currently a 10 year T-bond is at 4.10% (5/19/2005)

Therefore risk adjusted return is:

risk adjusted return=6.5%-4.10%=2.4%

2.4% spread over 10 year Treasuries seems like a very meager return for the amount of risk associated with investing in a retail property. Of course, if you leverage that up 95% by using debt and preferred equity maybe that becomes a worthy return. Then again at those heights if the property hiccups an investor could wipe out half their equity.

Risks of Retail

1. The past 5 years have seen record growth in consumer spending, which is driving retail property rent growth. However, job growth and wage growth have been essentially flat. The primary source of consumer spending has been increased leveraging, particularly of consumer's homes. Even if home prices continue to rise there is a limit to the amount of leverage people can take on and as we approach that limit increases in consumption driven by borrowing will decelerate. If interest rate rise without corresponding wage increases consumption will be reduced the increase debt servicing costs. Americans are not saving (current savings is less than 2% of disposable income), therefore increased debt service will automatically lead to reduced consumption. Reduced consumption will hurt retail rent growth.

2. Retail tenants are operating businesses. Therefore every year some are likely to fail and not pay their rent. There is little room with a 6% yield to have too many vacancies.

Retail Returns

A retail property trading at 6% cap rate typically has rent growth of about CPI +.5%. Therefore real return is:

Real Return = 6% + CPI + .5% -CPI = 6.5%

Currently a 10 year T-bond is at 4.10% (5/19/2005)

Therefore risk adjusted return is:

risk adjusted return=6.5%-4.10%=2.4%

2.4% spread over 10 year Treasuries seems like a very meager return for the amount of risk associated with investing in a retail property. Of course, if you leverage that up 95% by using debt and preferred equity maybe that becomes a worthy return. Then again at those heights if the property hiccups an investor could wipe out half their equity.

Tuesday, May 17, 2005

Exotic Financing Fans Fire

Excerpted from Money Magazine:

The rub is that fewer and fewer San Diegans have a standard mortgage. According to PMI Mortgage Insurance Co., more than two-thirds of the loans to buy homes here last year were interest-only mortgages, which have much lower monthly payments but much bigger bills to pay down the road.

San Diego home prices have risen 138% in the last 5 years, while incomes have gone up about 1% a year according to Office of Federal Housing Enterprise Oversight. This translates into only 11% of the population of San Diego being able to afford a median priced home on a conventional 30-year fixed mortgage. The result is that people are using interest only mortgages to "bet" on their homes increasing in value. This is a great bet as long as housing prices continue to rise, but watch out if they flatten out our fall.

INTEREST ONLY DANGERS:

1. Interest Adjustment

At the end of the initial 3,5,7 year interest only period the interest rates automatically adjusts to a market rate. These adjustable rates are indexed off the short end of the curve where it is safe to assume the Fed will continue tightening.

2. Principal Payments

At the end of the interest only period, the borrower must begin repaying principal, which instantly increases the monthly payment no matter where interest rates are, and is not tax-deductible.

3. Shorter Amortization Schedule

The principal must for 3,5,7 year interest only loans must repaid on a 27,25,23 year respectively amortization schedule. Shorter schedule means larger payments.

Of course, one can always refinance the loan into a fixed rate at the end of the interest only period to avoid these pitfalls. However, the majority of people utilized interest only instruments because they could not afford the house in the first place on a conventional fixed rate loan. And with incomes only increasing 2-3% annually it is doubtful that in 3-5 years they will be able to afford significantly higher payments to qualify for fixed rate mortgages.

The next, best hope for people in interest only loans whose payments are skyrocketing is to refinance into another interest only loan. Of course, they have paid down no principal in the preceding time period so the loan amount will be the same. As well, the Fed has made it very clear that short term rates are going to rise, which will increase the cost of borrowing dramatically. For instance, if you have a $500k interest only loan that was borrowed at last year's record lows of 4%, then you make monthly payments of $1,666. Assuming that short term interest rise another 100 bps by the time you need to refinance in 3 years your monthly payment will be $2083 or an increase of 25%.

The final hope will be for many of these interest only borrowers to sell to capture the equity and payoff their loans. The question is, if they all start selling at the same time, from 2006-2009, will there be enough buyers to afford these homes at higher interest rates?

The Sirens are enchanting many a home owner to become a "home investor" in California. But investors need to remember there is never a sure thing. If we are blinded by the beauty of gain we cannot see the perils of loss.

The rub is that fewer and fewer San Diegans have a standard mortgage. According to PMI Mortgage Insurance Co., more than two-thirds of the loans to buy homes here last year were interest-only mortgages, which have much lower monthly payments but much bigger bills to pay down the road.

San Diego home prices have risen 138% in the last 5 years, while incomes have gone up about 1% a year according to Office of Federal Housing Enterprise Oversight. This translates into only 11% of the population of San Diego being able to afford a median priced home on a conventional 30-year fixed mortgage. The result is that people are using interest only mortgages to "bet" on their homes increasing in value. This is a great bet as long as housing prices continue to rise, but watch out if they flatten out our fall.

INTEREST ONLY DANGERS:

1. Interest Adjustment

At the end of the initial 3,5,7 year interest only period the interest rates automatically adjusts to a market rate. These adjustable rates are indexed off the short end of the curve where it is safe to assume the Fed will continue tightening.

2. Principal Payments

At the end of the interest only period, the borrower must begin repaying principal, which instantly increases the monthly payment no matter where interest rates are, and is not tax-deductible.

3. Shorter Amortization Schedule

The principal must for 3,5,7 year interest only loans must repaid on a 27,25,23 year respectively amortization schedule. Shorter schedule means larger payments.

Of course, one can always refinance the loan into a fixed rate at the end of the interest only period to avoid these pitfalls. However, the majority of people utilized interest only instruments because they could not afford the house in the first place on a conventional fixed rate loan. And with incomes only increasing 2-3% annually it is doubtful that in 3-5 years they will be able to afford significantly higher payments to qualify for fixed rate mortgages.

The next, best hope for people in interest only loans whose payments are skyrocketing is to refinance into another interest only loan. Of course, they have paid down no principal in the preceding time period so the loan amount will be the same. As well, the Fed has made it very clear that short term rates are going to rise, which will increase the cost of borrowing dramatically. For instance, if you have a $500k interest only loan that was borrowed at last year's record lows of 4%, then you make monthly payments of $1,666. Assuming that short term interest rise another 100 bps by the time you need to refinance in 3 years your monthly payment will be $2083 or an increase of 25%.

The final hope will be for many of these interest only borrowers to sell to capture the equity and payoff their loans. The question is, if they all start selling at the same time, from 2006-2009, will there be enough buyers to afford these homes at higher interest rates?

The Sirens are enchanting many a home owner to become a "home investor" in California. But investors need to remember there is never a sure thing. If we are blinded by the beauty of gain we cannot see the perils of loss.

Monday, May 16, 2005

Inflation Picking Up

From 5/16/2005 Wall Street Journal:

56 leading economists surveyed by the WSJ: lifted their inflation forecasts. They now expect the consumer-price index to increase 2.9% on an annual basis in May and 2.7% in November. Those forecasts are higher than in April's survey, when CPI was seen rising 2.6% and 2.5% in May and November, respectively. The most recent government report, for March, showed a rise of 3.1%

If expections of future inflation continue to rise, then the Federal Reserve will be forced to continue to raise the short end of the curve. Currently, December Fed Fund futures are showing a 100% chance of rates going up 50 bps from the present 300 bps and 66% chance of rates going up 75 bps. This will have significant impact on the housing market, particularly the bubble markets in the eastern seaboard and California. These markets are being fueled by exotic loans that offer deep discount adjustable teaser rates and/or interest only payments, which are all priced off the short end of the curve.

How much of difference can these enivitable raises make? As an example, a house in my neighborhood was put on the market for $2.2 million. Assuming $500k down (they made a killing on their last house), my new neighbor will need a loan for $1.7 million. What will they do to afford it? Just like all my other new neighbors, Interest only loan. The current rate for an interest only is about 5%. That equates to monthly payments of $7,083. (I don't know how you can sleep at night with that kind of monthly) Now let's say that my new legal eagle neighbors can afford this (I assume only two lawyers would be dumb enough to do this) . What happens if they delay their purchase 6 months and the interest only rates, which are tied primarily to short term rates such as COFI, LIBOR, and 12-MTA rise another 75 bps? Assuming the most they can pay is $7,083/ month, then if rates went up 75 bps (which is what the Fed Fund futures rates are predicting) the largest loan they could afford would be $1.48 m. This would lower their offering price from $2.2 m to $1.98 m or a 10% decrease.

Of course the seller may choose to stay put if the price decreases too much. The point being that just because the long end of the curve continues to stay absurdly low, don't think that home prices or sales volume in very expensive markets can't be impacted by the short end moving.

56 leading economists surveyed by the WSJ: lifted their inflation forecasts. They now expect the consumer-price index to increase 2.9% on an annual basis in May and 2.7% in November. Those forecasts are higher than in April's survey, when CPI was seen rising 2.6% and 2.5% in May and November, respectively. The most recent government report, for March, showed a rise of 3.1%

If expections of future inflation continue to rise, then the Federal Reserve will be forced to continue to raise the short end of the curve. Currently, December Fed Fund futures are showing a 100% chance of rates going up 50 bps from the present 300 bps and 66% chance of rates going up 75 bps. This will have significant impact on the housing market, particularly the bubble markets in the eastern seaboard and California. These markets are being fueled by exotic loans that offer deep discount adjustable teaser rates and/or interest only payments, which are all priced off the short end of the curve.

How much of difference can these enivitable raises make? As an example, a house in my neighborhood was put on the market for $2.2 million. Assuming $500k down (they made a killing on their last house), my new neighbor will need a loan for $1.7 million. What will they do to afford it? Just like all my other new neighbors, Interest only loan. The current rate for an interest only is about 5%. That equates to monthly payments of $7,083. (I don't know how you can sleep at night with that kind of monthly) Now let's say that my new legal eagle neighbors can afford this (I assume only two lawyers would be dumb enough to do this) . What happens if they delay their purchase 6 months and the interest only rates, which are tied primarily to short term rates such as COFI, LIBOR, and 12-MTA rise another 75 bps? Assuming the most they can pay is $7,083/ month, then if rates went up 75 bps (which is what the Fed Fund futures rates are predicting) the largest loan they could afford would be $1.48 m. This would lower their offering price from $2.2 m to $1.98 m or a 10% decrease.

Of course the seller may choose to stay put if the price decreases too much. The point being that just because the long end of the curve continues to stay absurdly low, don't think that home prices or sales volume in very expensive markets can't be impacted by the short end moving.

Friday, May 13, 2005

Rents vs. Mortgages

California is experiencing the greatest rise in real estate prices since the 1880's boom in Los Angeles. Real estate brokers, home owners, and mortgage bankers swear that the 25% annual price appreciation is completely sustainable, because of high demand and constrained supply. Economists and scholars are starting to see a bubble market even drawing comparisons to the NASDAQ crash in 2001.

The reality is that no one truly knows what is going to happen. California may go the way of Australia and see a price drop 40% in the next few years. It may muddle through as it did in the 90's after the heavy job losses in the period from 1989-1992. Or it may continue to appreciate, as supply of developable land is exhausted.

While no one can accurately forecast future home prices, I believe the tea leaves are very clear for the future direction of rents in California. Peering into my crystal ball I foresee a rent spike in the next 18-24 months of 8-12% in a single year.

Any way you slice it, rents have to rise. If interest rates stay low and home prices continue to go up, then the spread between rents and mortgages will increase, and rents will rise. If interest rates rise and home prices flatten out, the increased cost of a mortgage will deter new home buyers and force people to stay in apartments, and rents will rise.

But why a huge spike of 8-12%?

1. Condo conversions

Condo conversions are sucking ten of thousands of units out of California. In San Diego, 56% of the apartment units sold in the last 2 years have been converted to condos. In LA, OC, and SF the figure is more like 30%, but still a significant figure when you consider the record deal volume in the last 2 years.

2. Condo Development

Condo developers are currently paying anywhere from 2-3x more than apartment developers for land. Condos are essentially crowding out apartment development.

3. Mortgage to Rent Spread

It is common knowledge that people will pay more on a monthly basis to own rather than rent. Owning gives one the opportunity for appreciation, instills pride, a sense of permanency, community, etc. Therefore a moderate premium of 20-30% makes some sense. For instance if you can rent a 1800 sf home for $2000/month than a mortgage payment of $2400-2600 is sensible. However, in cities like Irvine (in The OC) an 1800 sf home costs about $750,000. With 20% down you need a loan of $600,000 on a 30-year fixed at current rates of 5.85% (as of May 13, 2005) that is a monthly mortgage payment of $3,539. After property taxes and the interest deduction the net is about $3,200/month. By comparison, an 1800 sf home in Irvine rents for about $2300/month. This equates to a premium of about 40% for owning versus renting. To narrow to a more normal range like a 25% premium, rents would increase from $2300 to $2560 or 11%.

Just food for thought.

The reality is that no one truly knows what is going to happen. California may go the way of Australia and see a price drop 40% in the next few years. It may muddle through as it did in the 90's after the heavy job losses in the period from 1989-1992. Or it may continue to appreciate, as supply of developable land is exhausted.

While no one can accurately forecast future home prices, I believe the tea leaves are very clear for the future direction of rents in California. Peering into my crystal ball I foresee a rent spike in the next 18-24 months of 8-12% in a single year.

Any way you slice it, rents have to rise. If interest rates stay low and home prices continue to go up, then the spread between rents and mortgages will increase, and rents will rise. If interest rates rise and home prices flatten out, the increased cost of a mortgage will deter new home buyers and force people to stay in apartments, and rents will rise.

But why a huge spike of 8-12%?

1. Condo conversions

Condo conversions are sucking ten of thousands of units out of California. In San Diego, 56% of the apartment units sold in the last 2 years have been converted to condos. In LA, OC, and SF the figure is more like 30%, but still a significant figure when you consider the record deal volume in the last 2 years.

2. Condo Development

Condo developers are currently paying anywhere from 2-3x more than apartment developers for land. Condos are essentially crowding out apartment development.

3. Mortgage to Rent Spread

It is common knowledge that people will pay more on a monthly basis to own rather than rent. Owning gives one the opportunity for appreciation, instills pride, a sense of permanency, community, etc. Therefore a moderate premium of 20-30% makes some sense. For instance if you can rent a 1800 sf home for $2000/month than a mortgage payment of $2400-2600 is sensible. However, in cities like Irvine (in The OC) an 1800 sf home costs about $750,000. With 20% down you need a loan of $600,000 on a 30-year fixed at current rates of 5.85% (as of May 13, 2005) that is a monthly mortgage payment of $3,539. After property taxes and the interest deduction the net is about $3,200/month. By comparison, an 1800 sf home in Irvine rents for about $2300/month. This equates to a premium of about 40% for owning versus renting. To narrow to a more normal range like a 25% premium, rents would increase from $2300 to $2560 or 11%.

Just food for thought.

Subscribe to:

Posts (Atom)